Join the 1,512 others who are receiving high-signal, data-driven analysis to be in front of their peers in the cannabinoid space! If you have found value in our insights, please share this with another canna-curious individual to grow the revolution!

Each month we spend hours analyzing market research, data trends and private conservations to will keep you in front of the ever-evolving cannabinoid industry. Read the entire Report here

One Report, Once a Month, Everything you need to know

The article below is an excerpt from the Monthly Playbook.

The Future Of Lumber And Its Effect On Cannabis Consumers – June 2021 Monthly Playbook

At the time of writing this, July 2021 lumber futures are trading at $1540 per contract, which is a 337.5% increase in price from last year. The interesting thing about lumber future contracts is that they include both the finished lumber products, like as 2’ x 4’s for framing houses, along with pulp which is a byproduct of the milling process. The pulp is used to create paper, cardboard, corrugated cardboard, and other consumables. While the housing boom requires finished boards and is driving the price of lumber future contracts up, the pulp industry operates differently.

Typically, only half of the fiber used for paper manufacturing processes is derived sawmill pulp, and the other half comes directly from wood that was purposely harvested for paper. 5,6, The glut of pine trees in the United States is escalating the stock price, helping cushion sawmill margins.

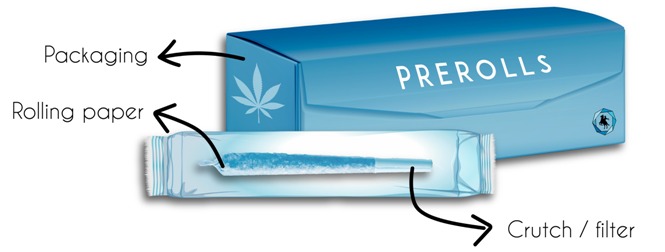

The cannabis industry is heavily reliant on paper products to package and label goods. The main product we believe could be the most effected by the increase in lumber and pulp prices is the pre-roll market. The total domestic market for pre-rolls in 2020 was ~$1.9 billion with ~200 million joints sold in the adult-use markets.

The average retail price is currently around $10.00 for a 0.7 gram cannabis pre-roll.7 If processors experience a 300% increase in packaging cost for pre-rolls (including the rolling paper, filter, packaging, and label), the consumer will most likely have to foot the bill. This spike in pulp pricing will inevitably lead to an increase in price for paper products. Considering the uptick in online shopping this year leading to increased demand for cardboard, we recommend locking in packaging inventory for the summer to avoid any dramatic price increases.