Each month we spend hours analyzing market research, data trends and private conservations to will keep you in front of the ever-evolving cannabinoid industry. Read the entire July Report here

One Report, Once a Month, Everything you need to know

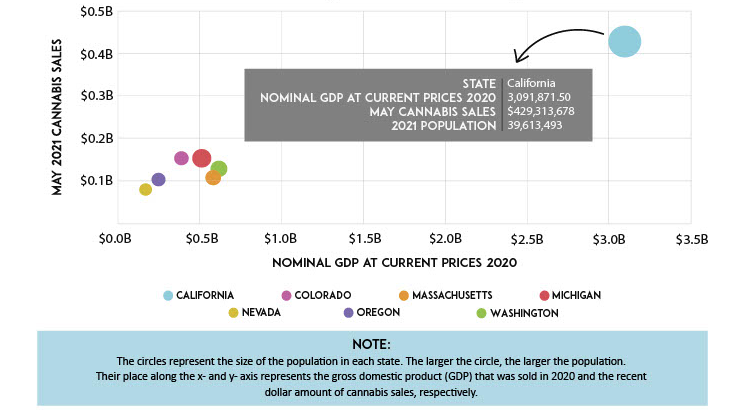

Forecasting Cannabis Basket size by Sales and GDP of States

While the legal cannabis landscape continues to expand into new state markets, there are several factors influencing executive teams when analyzing these strategic growth opportunities.

Nominal GDP AT CURRENT PRICES 2020 // MAY CANNABIS SALES // 2021 Population BY STATE

Over the past six months, several states have turned into hot markets for MSOs looking to expand. To understand the factors that influence market opportunity and visualize their correlation, we crossanalyzed population, nominal GDP, average basket size in existing markets, and May’s cannabis sales data. California, for example, contains more than 50% of the American adult population eligible to purchase cannabis, in addition to over 54% of the total nominal GDP amongst the 7 adult-use markets evaluated.7,8 This state, however, only accounts for 36% of the total monthly cannabis sales, demonstrating that the population and GDP may not serve as a direct correlation when understanding a state’s market opportunity.9

When you consider the average basket size in each of the states, a clearer picture emerges. In California, the average basket size is only $67.42, whereas in Michigan, the average basket size is $84.09.9 When comparing these stark differences, it is clear that the state’s population doesn’t play as much of a role as the amount each customer spends per trip and number of adults in the state consuming cannabis.